5th Money Laundering Directive 10 Beneficial Ownership

The idea of money laundering is essential to be understood for those working within the monetary sector. It is a process by which soiled cash is transformed into clear money. The sources of the cash in actual are criminal and the money is invested in a way that makes it appear to be clean money and conceal the id of the legal a part of the money earned.

While executing the financial transactions and establishing relationship with the new customers or maintaining existing prospects the duty of adopting sufficient measures lie on every one who is part of the group. The identification of such ingredient to start with is simple to cope with as an alternative realizing and encountering such situations in a while within the transaction stage. The central financial institution in any nation supplies complete guides to AML and CFT to combat such actions. These polices when adopted and exercised by banks religiously provide enough safety to the banks to discourage such situations.

The 5th Anti-Money laundering directive will. The Financial Action Task Force acknowledges that law firms are an attractive target for money launderers.

The Fifth Money Laundering Directive 5amld Explained In Detail By Yury Myshinskiy Medium

Increase transparency about who really owns companies and trusts to prevent money laundering and terrorist financing via opaque structures.

5th money laundering directive 10 beneficial ownership. Jersey has a long track record of high standards. Through the 5th Anti-Money Laundering Directive the EU introduced some significant and important changes to the requirements related to beneficial ownership transparency. 5MLD builds on those steps introducing the following measures.

Improve the work of FinancialUnits with. Welcome to the third of our monthly Fifth EU Money Laundering Directive 5MLD blog series where in the run up to its January 2020 implementation deadline we break down one of the key areas of the 5MLD letting you know what changes are coming and what you need to do. The 5th Money Laundering Directive was implemented on 10th January 2020 and is now known as.

In 2017 4MLD introduced a focus on ultimate beneficial ownership UBO for the purposes of risk mitigation and money laundering prevention. It was first published on June 19th 2018 in the Official Journal of the European Union as an iteration of the 4th Anti-Money Laundering Directive AMLD4. Cyprus Beneficial Ownership Register and other highlights of the amendments the 5th AMLD.

The transposition of this EU directive has resulted. Directive EU 2018843 of the European Parliament and of the Council of 30 May 2018 amending Directive EU 2015849 on the prevention of the use of the financial system for the purposes of money laundering or terrorist financing and amending Directives 2009138EC and 201336EU Text with EEA relevance PE722017REV1. International standards on collecting information on the beneficial owners are constantly changing.

Building on the regulatory regime applied under its predecessor 4AMLD 5AMLD reinforces the European Unions AMLCFT regime to address a number of emergent and ongoing issues. The directive is the latest measure in the worldwide fight against money laundering and terrorism financing across all sectors. In Europe the race is on for jurisdictional registries that hold ultimate beneficial ownership information to ensure their information is the required standard for 5AMLD.

See our April 2019 briefing discussing the potential impact from a corporate law perspective. First firms will be under a new obligation to report discrepancies between the information contained on public registers such as the register of persons of significant control and beneficial ownership information obtained through CDD. In order to combat tax evasion money laundering and terrorist financing it is important to know the individual who is ultimately behind every company the beneficial owner.

The tightening of UBO legislation including the EUs 5 th Anti-Money Laundering Directive 5AMLD has increased pressure on organizations to have an effective program in place. The FCA and professional sector service providers such as banks and others who can demonstrate a legitimate interest. The 5th Money Laundering Directive and the Register of the Ultimate Beneficial Owners.

Transparency of beneficial ownership Much of the focus of the Directive is on improving transparency of beneficial ownership including two significant changes. Policymakers didnt hang around and in April 2018 after only ten months European Parliament announced that it would adopt the 5th EU Anti-Money Laundering Directive 5MLD giving EU members 18months to transfer the directive into law. The impact of 5AMLD is far-reaching.

10 January 2020 Beneficial ownership for corporates to be set up by 10 March 2020 Beneficial ownership of trusts to be set up by 10 September 2020 Centralised automated mechanisms to allow identification of those who hold or control payment accounts and bank accounts to be set up by. Last year the Government consulted on the implementation of the Fifth Money Laundering Directive. Each member state in the EU should have transposed the 5th Anti Money Laundering Directive AMLD into national legislation by the 10th of January 2020.

A firms data on beneficial owners will be made accessible to competent authorities ie. By making significant changes to the existing regulatory framework EU member states aim in becoming more. The Fifth Money Laundering Directive 5AMLD came into force on January 10 2020.

Beneficial Ownership The new regulation imposes greater transparency on the financial sector regarding beneficial ownership with a focus on the beneficial ownership of trusts. The 5th Anti-money Laundering Directive 5AMLD came into effect in the UK on 10 January. The final directive was adopted in Spring 2018 and entered into force on 9 July 2018.

The transposition of 5MLD introduced a number of amendments to the Register of Ultimate Beneficial. UBO lists drawn up under 4MLD are to be made publicly accessible. On the 13 th March 2020 Gibraltar transposed the EU 5 th Money Laundering Direction 5MLD through the Proceeds of Crime Act 2015 Amendment Regulations 2020.

The deadline is January 2020. 5AMLD 5th Anti-Money Laundering Directive. The Money Laundering and Terrorist Financing Amendment Regulations 2019.

Fifth EU Money Laundering Directive - Beneficial Ownership Transparency. The 5th Anti-Money Laundering Directive AMLD5 is an update to the European Unions anti-money laundering AML legal framework. The Money Laundering and Terrorist Financing Amendment Regulations 2019 have now been published and come into force on 10 January 2020.

Https Www Walkersglobal Com Images Publications Advisory 2020 Dublin Ireland Update Publication Of Draft Legislation Implementing Fifth Anti Money Laundering Directive Sept2020 Pdf

A Brief Summary On 5th Aml Directive Of Eu

Seven Key Principles Of The 5th Eu Anti Money Laundering Directive Amld Techprospect

Eu 5th Anti Money Laundering Directives By Argos Medium

Retrospective 5th Eu Money Laundering Directive Blog Merlon

Eu 5th Eu Anti Money Laundering Directive Published

5amld The Fifth Anti Money Laundering Directive By Trulioo The Regtech Hub Medium

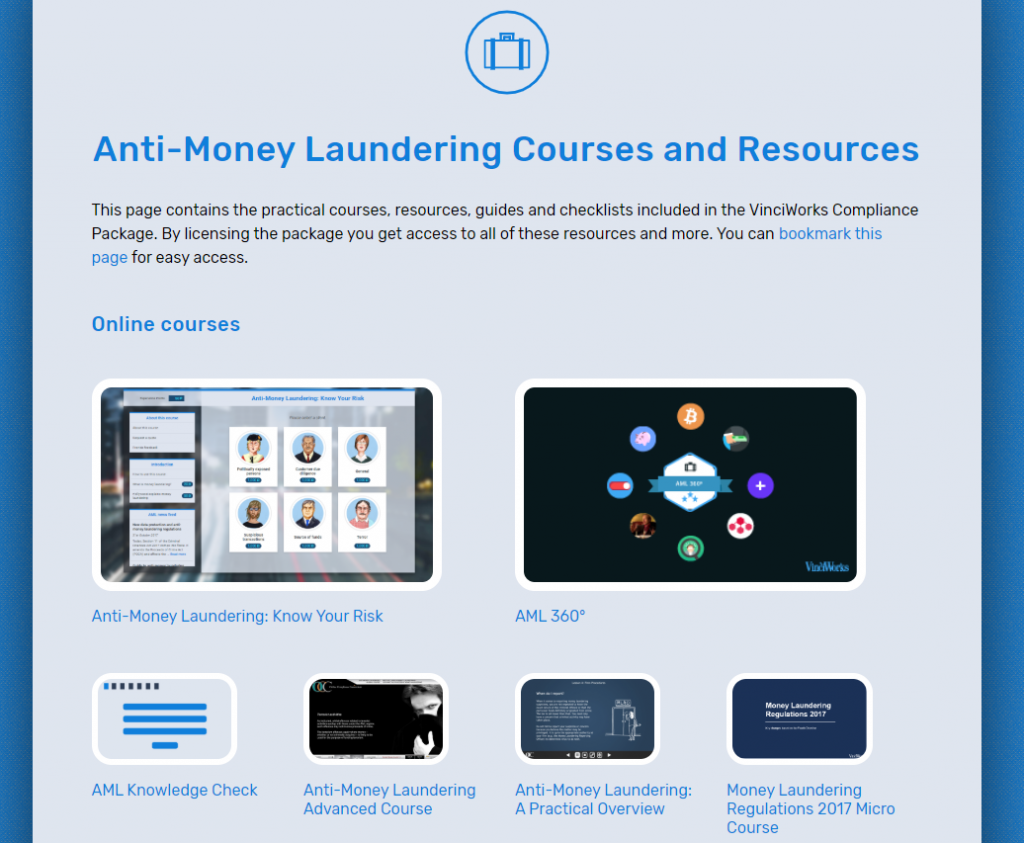

What Is The Fifth Money Laundering Directive Vinciworks Blog

Http Www Europarl Europa Eu Regdata Etudes Brie 2017 607260 Eprs Bri 2017 607260 En Pdf

How Does The Eu S Anti Money Laundering Directive Impact The Digital Identity Verification Process Softelligence

Forget Anonymity The Fifth Anti Money Laundering By Craig Wright Bitcoin Sv Is Bitcoin Predict Medium

The 5th Aml Directive Expected Changes To Local Legislation

5mld 5th Eu Anti Money Laundering Directive What You Need To Know Integress Compliance Advisory Training

Ultimate Beneficial Ownership And The Fifth Directive Vinciworks Blog

The world of regulations can seem to be a bowl of alphabet soup at instances. US money laundering laws are no exception. We've compiled a list of the top ten money laundering acronyms and their definitions. TMP Risk is consulting firm centered on protecting financial services by lowering risk, fraud and losses. Now we have huge bank experience in operational and regulatory risk. We now have a powerful background in program administration, regulatory and operational threat as well as Lean Six Sigma and Business Process Outsourcing.

Thus money laundering brings many antagonistic consequences to the organization because of the dangers it presents. It will increase the likelihood of major risks and the chance price of the bank and ultimately causes the financial institution to face losses.

Comments

Post a Comment